How to Apply for the Monzo Flex Credit Card Quick Easy Guide

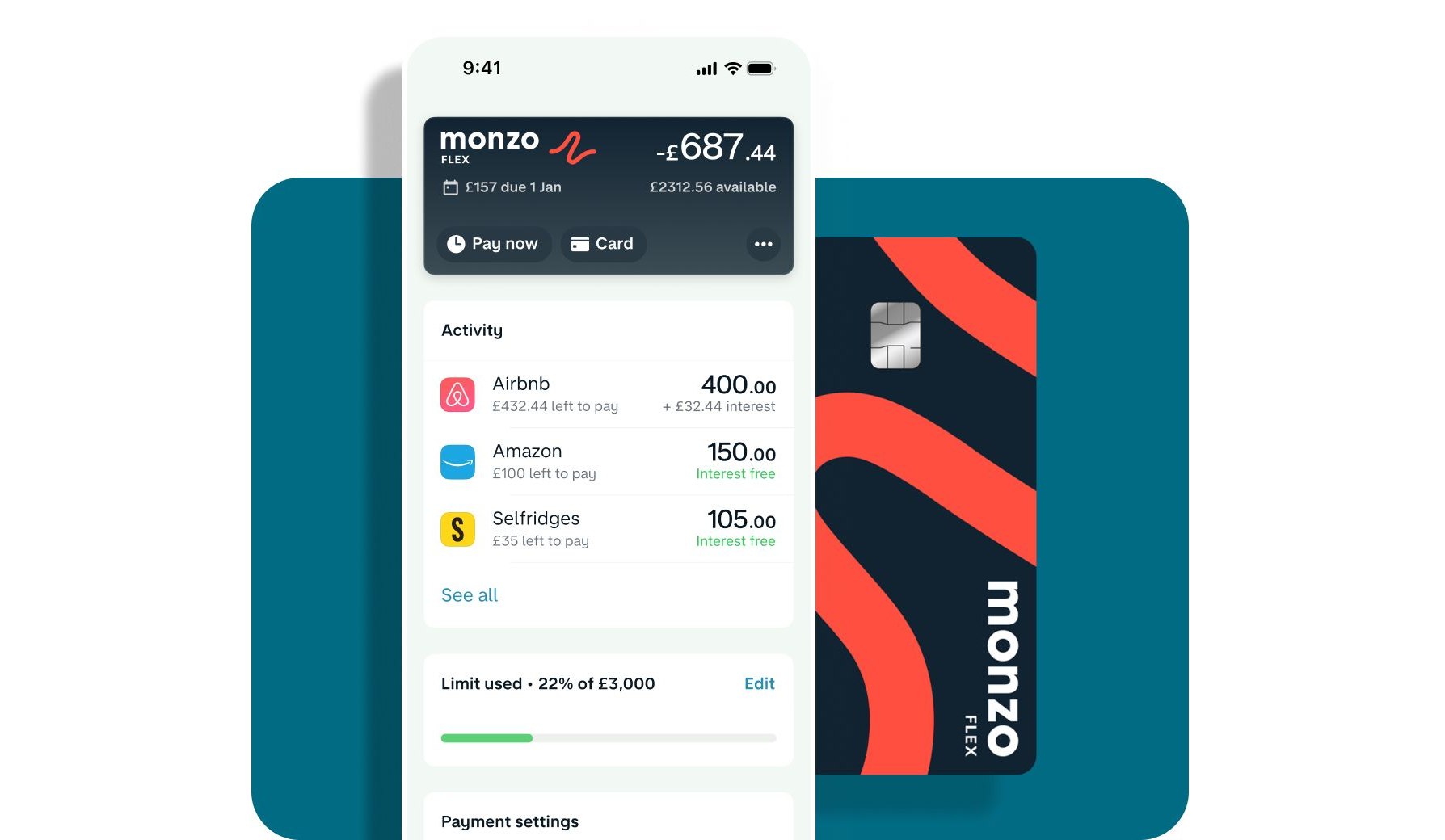

Ever found yourself caught off guard by an unexpected expense, only to wish there was a simple way to manage it without financial strain? With Monzo Flex, a revolutionary approach to credit, you can now smoothly handle those surprises. Designed with UK consumers in mind, Monzo Flex is more than just a typical credit card—it’s a smart financial tool that lets you split large payments into manageable portions.

No interest rates if paid in three installments, and for longer repayment plans, there’s a clear, competitive rate. This card empowers you to stay on top of your spending without hidden fees or tricky terms. Plus, the application process is straightforward and entirely digital. Dive into the Monzo app, apply for your card, and get an instant decision. It’s a breath of fresh air in the often confusing world of credit. Ready to learn more?

Benefits of the Monzo Flex Credit Card

Flexible Payment Options

The Monzo Flex Credit Card offers unparalleled flexibility with its unique payment structure. You can spread the cost of purchases over three installments with 0% interest, or over six and twelve installments with a competitive rate. This flexibility makes managing larger expenses easier and more manageable. For instance, if you need to replace a household appliance unexpectedly, the Monzo Flex allows you to spread the cost over a period that suits your budget, ensuring you’re not caught off-guard by a hefty one-time expense.

Real-Time Spending Notifications

Stay on top of your finances with real-time spending notifications sent straight to your phone. Each time you make a purchase with your Monzo Flex Credit Card, you’ll receive an immediate alert. This feature helps you control your spending and provides a clear overview of your financial activities, assisting in avoiding overspending. Keep an eye on every transaction effortlessly and enjoy peace of mind knowing you’re in control of your financial health.

No Fees for Early Repayment

Unlike many other credit cards, the Monzo Flex Credit Card does not charge fees for early repayment. This means you have the freedom to clear your balance when it suits you, possibly helping you save on interest charges for longer-term plans. It’s a fantastic benefit for those who prefer to manage their finances proactively and want the reassurance of not being penalised for paying off debt ahead of schedule.

Strong Support and Accessibility

The Monzo Flex Credit Card is backed by Monzo’s excellent customer service. With 24/7 support via the Monzo app, you can easily solve any issue or query you may have. This ensures that help is always available whenever you need it, which is particularly reassuring in moments of urgency. Additionally, the Monzo app makes it simple to track spending, set budgets, and manage your accounts, ensuring ease of use and accessibility.

SIGN UP TO GET YOUR MONZO FLEX CREDIT CARD

| Feature | Benefit |

|---|---|

| Flexible Repayment | Allows you to choose your repayment plan every month, making it easier to manage cash flow. |

| No Hidden Fees | Transparency in fees provides peace of mind, ensuring you only pay what you expect. |

The Monzo Flex Credit Card is designed to offer flexibility and convenience. One of its standout features is the ability to set your repayment plan each month. This means that if you have a tighter budget one month, you can adjust your payment accordingly. This flexibility allows individuals to take control of their finances, which can be incredibly beneficial in today’s unpredictable economy.Additionally, the Monzo Flex Credit Card prides itself on being free of hidden fees. This commitment to transparency translates into trust between the user and the bank. Knowing exactly what you’re paying for and avoiding unexpected costs can make managing personal finances much simpler and stress-free. By adopting this clear pricing strategy, Monzo demonstrates its customer-focused approach, aiming to build strong relationships with its users and encouraging responsible spending habits.

Requirements for Applying to Monzo Flex Credit Card

- UK Residency: You must be a resident of the United Kingdom to apply for the Monzo Flex Credit Card. This means having a permanent address within the UK.

- Age Criteria: Applicants need to be at least 18 years old. This is a standard legal requirement for credit card eligibility, ensuring that applicants are considered adults by law.

- Monzo Account Holder: To apply for Monzo Flex, you should already have a Monzo account. Monzo Flex is conveniently managed directly within the Monzo app, making it exclusive to account holders.

- Good Credit Score: A healthy credit history is vital. Monzo Flex assesses your credit score to ensure that you are a responsible borrower. Aim for a good score to maximize your chances of approval.

- Proof of Income: Providing details of your income helps Monzo gauge your repayment capacity. This could include a recent payslip or a bank statement showing regular deposits.

VISIT THE WEBSITE TO LEARN MORE

How to Apply for the Monzo Flex Credit Card

Step 1: Visit the Monzo Website or Open the Monzo App

To start your application for the Monzo Flex Credit Card, you’ll need to head to the Monzo website or use the Monzo mobile app. If you are not already a Monzo customer, you will need to download the app from the Google Play Store or Apple App Store and sign up for a Monzo bank account first. Existing customers can log in to access their banking features.

Step 2: Navigate to the Monzo Flex Section

Once logged into the app or on the website, look for the section dedicated to Monzo Flex. This can usually be found under the “Loans & Credits” category. Clicking on the Monzo Flex option will take you to a page where you can read more about the features, benefits, and terms of the Monzo Flex Credit Card.

Step 3: Review Eligibility Requirements

Before proceeding with your application, ensure you meet the eligibility criteria. Generally, you need to be over 18 years old and a resident of the UK. Additionally, Monzo might check your credit report to assess your application, so ensuring that your credit information is accurate and up to date is advisable.

Step 4: Submit Your Application

After reviewing the eligibility criteria and understanding the terms, proceed to fill out the online application form. You will need to provide some personal information, including your income and employment details, to help Monzo assess your application. Ensure all the information provided is accurate to avoid any delays in processing.

Step 5: Await Approval and Receive Your Card

Once your application is submitted, Monzo will review your information and make a decision. You should receive a notification regarding your application status, either through the Monzo app or via email. If approved, your Monzo Flex Credit Card will be delivered to your registered address, and you can start using it according to the terms and conditions. Remember, activating your card might require a few simple steps which will be provided upon approval.

SIGN UP TO GET YOUR MONZO FLEX CREDIT CARD

Frequently Asked Questions about Monzo Flex Credit Card

What is the Monzo Flex Credit Card?

The Monzo Flex Credit Card is not just a standard credit card; it’s combined with a flexible loan feature. This card allows you to spread the cost of your purchases over several months, offering you more control over your finances. You’ll only pay interest on the amount you choose to finance, making it a convenient option for managing larger expenses.

How does the financing on Monzo Flex work?

With the Monzo Flex Credit Card, you can choose to repay your purchases over 3, 6, or 12 months. Let’s say you buy a new appliance costing £600. You can decide to repay that amount in manageable monthly installments. The Flex feature offers you the flexibility to select the timeline that suits your budget, helping to spread the cost and minimize immediate financial strain.

Are there any fees associated with Monzo Flex?

Monzo Flex primarily charges interest on the financed amount, so you will not encounter unexpected hidden fees. However, it’s crucial to review the terms before any purchase to understand the applicable interest rates clearly. Unlike some traditional credit cards, Monzo Flex is straightforward concerning the costs involved, aiming to maintain transparency with its users.

Am I eligible to apply for the Monzo Flex Credit Card?

Eligibility for the Monzo Flex Credit Card depends on several factors, including your credit history and income level. Being a Monzo customer is a prerequisite, as the Flex feature is integrated within the Monzo app. Existing banks or customers usually find the application process quite seamless. It’s advisable to check your credit score and financial standing before applying to enhance your chances of approval.

Can I pay off my Monzo Flex balance early?

Yes, one of the advantages of the Monzo Flex Credit Card is that you can pay off your balance early without incurring additional fees. This flexibility allows you to save on interest costs if you find yourself in a position to make early repayments, giving you more control over how you manage your finances.

Related posts:

The Evolution of Credit Cards: Future Trends and Emerging Technologies

Apply for Barclaycard Platinum Easy Steps to Get Your Credit Card

The Pros and Cons of Credit Cards: What You Need to Know

How to Apply for the American Express Cashback Credit Card Effortlessly

How to Choose the Ideal Credit Card for Your Financial Needs

How to Apply for the Halifax World Elite Mastercard Credit Card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.