How Inflation Affects Your Personal Budget and Strategies to Protect Yourself

Understanding Inflation’s Impact

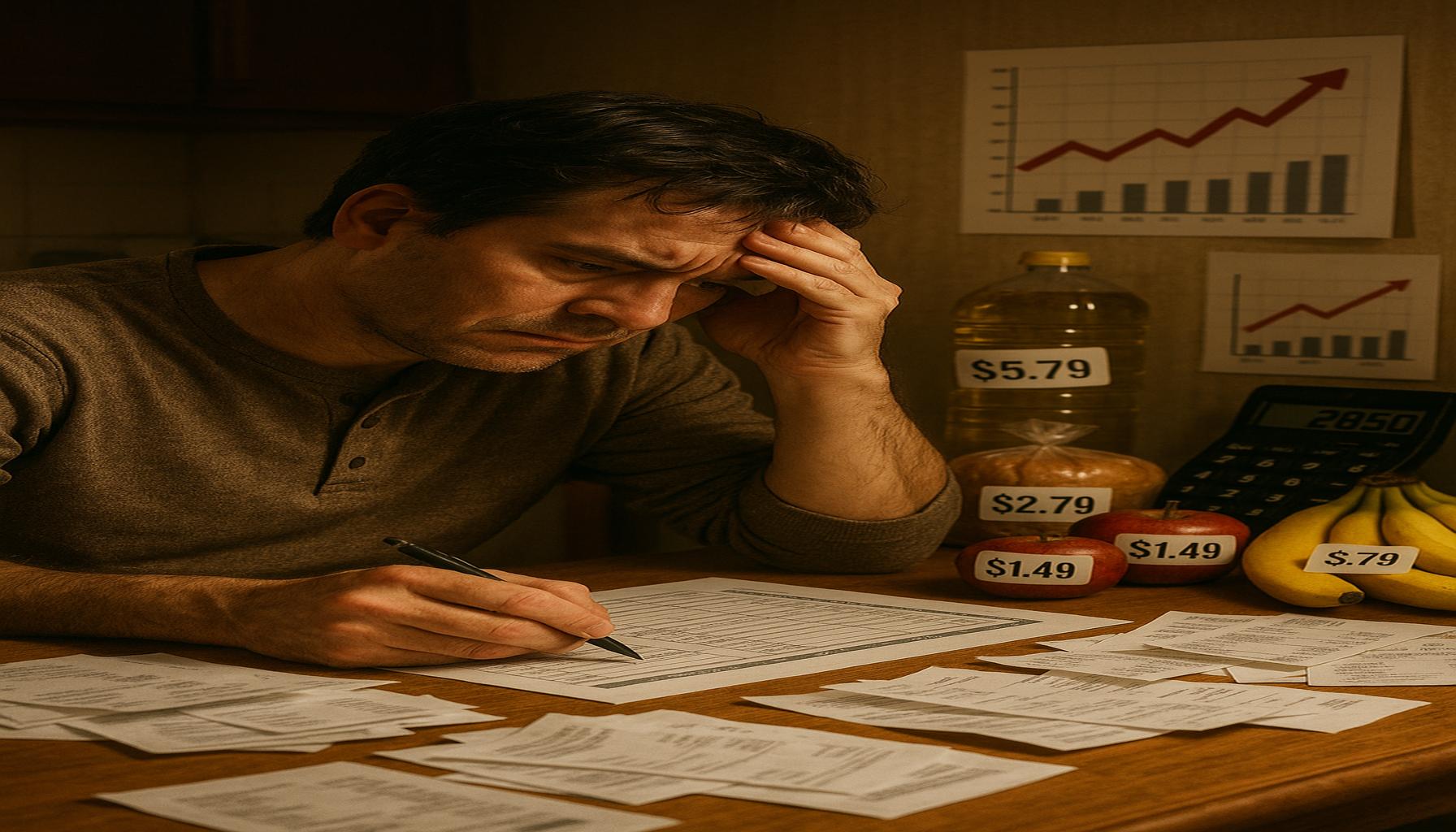

Inflation can significantly influence your personal finances in ways you might not realise. When the cost of goods and services rises, the purchasing power of your money diminishes. This can lead to essential changes in your budget and how you manage your finances on a daily basis. It’s crucial to understand the implications of inflation for your everyday life, especially in an economy like the UK’s where recent trends have shown noticeable price increases across various sectors.

Key Effects of Inflation

- Increased Cost of Living: Essentials such as food, energy, and transportation may become more expensive over time. For example, the price of groceries has been on the rise, making it essential for households to adjust their shopping habits and consider bulk buying to save costs. The impact of gas and electric price hikes also weighs heavily on budget concerns, leading to increased utility bills every month.

- Reduced Savings Value: Money saved today can lose its value quickly due to inflation, which might affect future purchases. For instance, if your savings account offers an interest rate lower than the inflation rate, the real value of your savings decreases. This means that what you can buy with the money saved today will not be the same in the future.

- Interest Rate Impacts: As inflation rises, central banks, like the Bank of England, may decide to increase interest rates to combat it. This move affects loans, mortgages, and credit cards, potentially leading to higher monthly repayments. For example, a rise in the Bank of England’s base rate can directly influence your mortgage rate, costing homeowners more over time if they are on a variable rate.

Considering these challenges, it’s essential to develop strategies that will help you safeguard your finances against inflationary pressures. Carefully adjusting your budget may be necessary to ensure your financial stability. Here are some methods to consider:

Strategies to Protect Yourself

- Track Spending: Keeping a close eye on your expenses helps identify areas where you can cut back. Use budgeting apps or spreadsheets to categorise your spending and set limits. For example, by reducing discretionary spending on dining out or entertainment, you can channel more funds into essential purchases.

- Diversify Income: Consider side gigs or passive income streams to bolster your earnings. This could include freelance work, crafting, or even renting out a spare room through platforms like Airbnb, providing a cushion against rising costs.

- Invest Wisely: Look into inflation-resistant assets such as real estate or commodities like gold. These investments have historically outperformed cash savings during inflationary periods, helping to preserve your wealth over time.

By understanding these effects and implementing effective strategies, you can better navigate the challenges presented by inflation. This guide aims to equip you with the knowledge needed to manage your personal budget successfully in an inflationary environment, empowering you to protect your financial well-being and make informed decisions amid rising prices.

DISCOVER MORE: Click here for a step-by-step guide

Understanding Inflation’s Impact

Inflation can significantly influence your personal finances in ways you might not realise. When the cost of goods and services rises, the purchasing power of your money diminishes. This can lead to essential changes in your budget and how you manage your finances on a daily basis. It’s crucial to understand the implications of inflation for your everyday life, especially in an economy like the UK’s where recent trends have shown noticeable price increases across various sectors.

Key Effects of Inflation

- Increased Cost of Living: Essentials such as food, energy, and transportation may become more expensive over time. For example, the price of groceries has been on the rise, making it essential for households to adjust their shopping habits and consider bulk buying to save costs. The impact of gas and electric price hikes also weighs heavily on budget concerns, leading to increased utility bills every month.

- Reduced Savings Value: Money saved today can lose its value quickly due to inflation, which might affect future purchases. For instance, if your savings account offers an interest rate lower than the inflation rate, the real value of your savings decreases. This means that what you can buy with the money saved today will not be the same in the future.

- Interest Rate Impacts: As inflation rises, central banks, like the Bank of England, may decide to increase interest rates to combat it. This move affects loans, mortgages, and credit cards, potentially leading to higher monthly repayments. For example, a rise in the Bank of England’s base rate can directly influence your mortgage rate, costing homeowners more over time if they are on a variable rate.

Considering these challenges, it’s essential to develop strategies that will help you safeguard your finances against inflationary pressures. Carefully adjusting your budget may be necessary to ensure your financial stability. Here are some methods to consider:

Strategies to Protect Yourself

- Track Spending: Keeping a close eye on your expenses helps identify areas where you can cut back. Use budgeting apps or spreadsheets to categorise your spending and set limits. For example, by reducing discretionary spending on dining out or entertainment, you can channel more funds into essential purchases.

- Diversify Income: Consider side gigs or passive income streams to bolster your earnings. This could include freelance work, crafting, or even renting out a spare room through platforms like Airbnb, providing a cushion against rising costs.

- Invest Wisely: Look into inflation-resistant assets such as real estate or commodities like gold. These investments have historically outperformed cash savings during inflationary periods, helping to preserve your wealth over time.

By understanding these effects and implementing effective strategies, you can better navigate the challenges presented by inflation. This guide aims to equip you with the knowledge needed to manage your personal budget successfully in an inflationary environment, empowering you to protect your financial well-being and make informed decisions amid rising prices.

DISCOVER MORE: Click here to learn how financial goals can enhance your budgeting motivation</

Adapting Your Budget to Inflation

Adjusting your budget in response to inflation is crucial for maintaining financial stability. As prices rise, it may be necessary to re-evaluate your current spending habits and financial commitments. By proactively adapting your budget, you can mitigate the impact of inflation on your household.

Reassessing Fixed and Variable Expenses

- Cutting Unnecessary Fixed Costs: While certain expenses are fixed, like your rent or mortgage, it’s still possible to negotiate or reassess some of these costs. For instance, if you’re nearing the end of your fixed-rate energy contract, it’s a good idea to shop around for a new provider that offers a better deal. By doing so, you may find significant savings, helping to lessen the burden of rising energy prices.

- Controlling Variable Expenses: Variable expenses can often be adjusted more easily. Review areas such as groceries, entertainment, and personal care. By planning meals and creating shopping lists, you can avoid impulse buys and take advantage of sales or special offers. Additionally, consider using supermarket loyalty cards that offer discounts or points that can be redeemed for future purchases.

Emergency Fund and Short-Term Savings

Inflation can wreak havoc on savings, so it’s important to prioritise your emergency fund. While the traditional advice is to save three to six months’ worth of expenses, during inflationary periods, you may want to aim for a more substantial buffer. This fund acts as a financial safety net, providing security against unexpected expenses that can arise from rising costs, such as car repairs or medical bills.

Exploring Inflation-Hedged Investments

- Consider Inflation-Linked Bonds: In the UK, you might find options like Index-Linked Gilts, which are government securities whose payments are adjusted according to inflation rates. By investing in these bonds, you can ensure that your investment keeps pace with inflation, maintaining your purchasing power over time.

- Invest in Stocks: Stocks typically provide a higher potential return than cash savings. While they come with risks, investing in businesses known for increasing their prices along with inflation can protect your capital. Look for companies within sectors such as utilities or consumer staples, which tend to remain robust during economic turbulence.

Re-evaluating Insurance Policies

It’s also wise to periodically reassess your insurance policies. As inflation drives up the cost of replacement items, ensure that your home and contents insurance reflects the true value of what you own. Consider increasing your coverage limits to adequately protect against potential losses. This will ensure that you’re not underinsured in the event of damage or theft, which could leave you facing a significant financial gap due to inflation’s depreciation of money’s purchasing power.

Adjusting to inflation requires ongoing vigilance and adaptability, allowing you to ensure that your personal budget remains secure amidst ever-changing economic conditions. By implementing these strategies, you not only safeguard yourself today but also prepare for the uncertainties of tomorrow.

DISCOVER MORE: Click here for practical budgeting tips

Conclusion

In conclusion, understanding how inflation affects your personal budget is essential for navigating today’s financial landscape. As prices rise, the real value of your income can diminish, making it necessary to revisit your spending habits and savings strategies. By reassessing both fixed and variable expenses, you can identify areas where adjustments can lead to significant savings. This approach enables you to allocate resources more effectively, ensuring that essential needs are met without compromising your financial stability.

Moreover, bolstering your emergency fund during inflation becomes a proactive measure for unforeseen circumstances, providing a cushion against unexpected costs. Coupled with exploring inflation-hedged investments like Index-Linked Gilts or investing in resilient stocks, you can safeguard your long-term financial interests. Regularly reviewing your insurance policies also plays a crucial role in protecting your assets from inflation-related depreciation.

Ultimately, while inflation is an inevitable part of the economic cycle, taking informed steps to adapt can empower you to maintain control over your finances. By implementing these practical strategies, you not only enhance your immediate financial resilience but also prepare for future uncertainties with confidence. The key is to stay alert, remain adaptable, and be proactive in shaping a budget that aligns with the realities of inflation.

Related posts:

How to Create an Effective Personal Budget: Practical Tips for Daily Life

The impact of financial goals on the motivation to maintain a personal budget

Strategies to Save and Invest: Balancing Personal Budget with Financial Goals

The importance of monthly budget review: How to adjust your finances over time

Strategies for Saving on Big Purchases: Planning Within Your Budget

How to Create an Effective Personal Budget: Practical Tips for Beginners

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.